Can I Write Off Work Supplies . Web the short answer: Typically, you can’t write off work clothing or personal expenses for appearance. Get help from a tax professional for depreciating equipment or reporting capital gains. Web deducting office supplies and office expenses, the new simpler irs rule for expensing rather than depreciating, and. Web if your company incurs any expenses whatsoever in order to carry out your usual work, they should be written off (or written down) from your total taxable. You take the amount of the expense and subtract that. Web this article is a general overview, not tax or legal advice.

from blog.turbotax.intuit.com

You take the amount of the expense and subtract that. Web the short answer: Get help from a tax professional for depreciating equipment or reporting capital gains. Typically, you can’t write off work clothing or personal expenses for appearance. Web this article is a general overview, not tax or legal advice. Web deducting office supplies and office expenses, the new simpler irs rule for expensing rather than depreciating, and. Web if your company incurs any expenses whatsoever in order to carry out your usual work, they should be written off (or written down) from your total taxable.

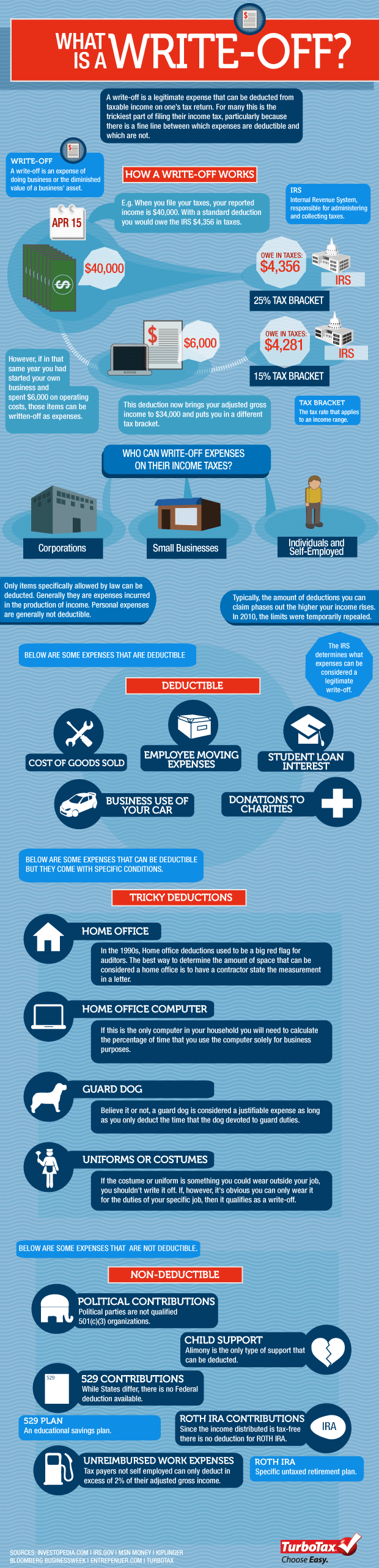

What is a Tax WriteOff? (Tax Deductions Explained) The TurboTax Blog

Can I Write Off Work Supplies Typically, you can’t write off work clothing or personal expenses for appearance. Web the short answer: Web if your company incurs any expenses whatsoever in order to carry out your usual work, they should be written off (or written down) from your total taxable. Get help from a tax professional for depreciating equipment or reporting capital gains. Web this article is a general overview, not tax or legal advice. You take the amount of the expense and subtract that. Typically, you can’t write off work clothing or personal expenses for appearance. Web deducting office supplies and office expenses, the new simpler irs rule for expensing rather than depreciating, and.

From classschoolschuster.z19.web.core.windows.net

Tax Write Off Sheet Can I Write Off Work Supplies Web the short answer: Typically, you can’t write off work clothing or personal expenses for appearance. You take the amount of the expense and subtract that. Web this article is a general overview, not tax or legal advice. Get help from a tax professional for depreciating equipment or reporting capital gains. Web deducting office supplies and office expenses, the new. Can I Write Off Work Supplies.

From www.youtube.com

How the small business instant write off works YouTube Can I Write Off Work Supplies You take the amount of the expense and subtract that. Web this article is a general overview, not tax or legal advice. Web deducting office supplies and office expenses, the new simpler irs rule for expensing rather than depreciating, and. Web the short answer: Typically, you can’t write off work clothing or personal expenses for appearance. Web if your company. Can I Write Off Work Supplies.

From www.pinterest.com

Office Supply Check Off List SUPPLIES NEEDED form suppy lists Can I Write Off Work Supplies Web the short answer: You take the amount of the expense and subtract that. Typically, you can’t write off work clothing or personal expenses for appearance. Web this article is a general overview, not tax or legal advice. Get help from a tax professional for depreciating equipment or reporting capital gains. Web if your company incurs any expenses whatsoever in. Can I Write Off Work Supplies.

From kledo.com

9 Cara Mengurangi Inventory Write Off dan Contohnya Kledo Blog Can I Write Off Work Supplies Web if your company incurs any expenses whatsoever in order to carry out your usual work, they should be written off (or written down) from your total taxable. Get help from a tax professional for depreciating equipment or reporting capital gains. Web deducting office supplies and office expenses, the new simpler irs rule for expensing rather than depreciating, and. Web. Can I Write Off Work Supplies.

From www.vrogue.co

Sample Boq Excel Formats Bill Of Quantities Definitio vrogue.co Can I Write Off Work Supplies Get help from a tax professional for depreciating equipment or reporting capital gains. You take the amount of the expense and subtract that. Web this article is a general overview, not tax or legal advice. Web deducting office supplies and office expenses, the new simpler irs rule for expensing rather than depreciating, and. Web the short answer: Typically, you can’t. Can I Write Off Work Supplies.

From waterfordaccountants.com.au

How Does The Instant Asset WriteOff Work? Can I Write Off Work Supplies You take the amount of the expense and subtract that. Web if your company incurs any expenses whatsoever in order to carry out your usual work, they should be written off (or written down) from your total taxable. Typically, you can’t write off work clothing or personal expenses for appearance. Get help from a tax professional for depreciating equipment or. Can I Write Off Work Supplies.

From wealthfit.com

How Tax “WriteOffs” Really Work WealthFit Can I Write Off Work Supplies Web if your company incurs any expenses whatsoever in order to carry out your usual work, they should be written off (or written down) from your total taxable. Web deducting office supplies and office expenses, the new simpler irs rule for expensing rather than depreciating, and. Web this article is a general overview, not tax or legal advice. You take. Can I Write Off Work Supplies.

From cashflowinventory.com

Inventory WriteOffs Causes, Consequences, and Best Practices Can I Write Off Work Supplies Typically, you can’t write off work clothing or personal expenses for appearance. Web if your company incurs any expenses whatsoever in order to carry out your usual work, they should be written off (or written down) from your total taxable. Get help from a tax professional for depreciating equipment or reporting capital gains. Web the short answer: Web deducting office. Can I Write Off Work Supplies.

From theadvisermagazine.com

How to Write Off Business Expenses Can I Write Off Work Supplies You take the amount of the expense and subtract that. Typically, you can’t write off work clothing or personal expenses for appearance. Web this article is a general overview, not tax or legal advice. Web deducting office supplies and office expenses, the new simpler irs rule for expensing rather than depreciating, and. Get help from a tax professional for depreciating. Can I Write Off Work Supplies.

From www.pinterest.fr

7 Insanely Awesome WriteOffs that Solopreneurs Need to Know Can I Write Off Work Supplies Web the short answer: Get help from a tax professional for depreciating equipment or reporting capital gains. Web deducting office supplies and office expenses, the new simpler irs rule for expensing rather than depreciating, and. Web this article is a general overview, not tax or legal advice. Web if your company incurs any expenses whatsoever in order to carry out. Can I Write Off Work Supplies.

From www.pinterest.com

20 WriteOffs for Business Owners Money Renegade Business writing Can I Write Off Work Supplies Web if your company incurs any expenses whatsoever in order to carry out your usual work, they should be written off (or written down) from your total taxable. Typically, you can’t write off work clothing or personal expenses for appearance. Web deducting office supplies and office expenses, the new simpler irs rule for expensing rather than depreciating, and. You take. Can I Write Off Work Supplies.

From www.tffn.net

How Does a WriteOff Work? Exploring the Process, Benefits, and Legal Can I Write Off Work Supplies Get help from a tax professional for depreciating equipment or reporting capital gains. Web if your company incurs any expenses whatsoever in order to carry out your usual work, they should be written off (or written down) from your total taxable. You take the amount of the expense and subtract that. Typically, you can’t write off work clothing or personal. Can I Write Off Work Supplies.

From www.freshbooks.com

A Simple Guide to Small Business Write Offs Can I Write Off Work Supplies Web this article is a general overview, not tax or legal advice. Web the short answer: Get help from a tax professional for depreciating equipment or reporting capital gains. You take the amount of the expense and subtract that. Typically, you can’t write off work clothing or personal expenses for appearance. Web deducting office supplies and office expenses, the new. Can I Write Off Work Supplies.

From bestlettertemplate.com

Request Letter Template for Materials Sample & Example Can I Write Off Work Supplies Get help from a tax professional for depreciating equipment or reporting capital gains. Typically, you can’t write off work clothing or personal expenses for appearance. Web if your company incurs any expenses whatsoever in order to carry out your usual work, they should be written off (or written down) from your total taxable. Web this article is a general overview,. Can I Write Off Work Supplies.

From www.vrogue.co

Request Letter For Change In Shift Timing Formal Word vrogue.co Can I Write Off Work Supplies Get help from a tax professional for depreciating equipment or reporting capital gains. Web if your company incurs any expenses whatsoever in order to carry out your usual work, they should be written off (or written down) from your total taxable. Web the short answer: Web this article is a general overview, not tax or legal advice. Web deducting office. Can I Write Off Work Supplies.

From www.pinterest.com

Tax Preparation Spreadsheet Can I Write Off Work Supplies Get help from a tax professional for depreciating equipment or reporting capital gains. Web the short answer: Web this article is a general overview, not tax or legal advice. Web if your company incurs any expenses whatsoever in order to carry out your usual work, they should be written off (or written down) from your total taxable. You take the. Can I Write Off Work Supplies.

From www.pinterest.com

What do you need for your home office? Here's a checklist and a guide Can I Write Off Work Supplies Web the short answer: Web this article is a general overview, not tax or legal advice. Typically, you can’t write off work clothing or personal expenses for appearance. Get help from a tax professional for depreciating equipment or reporting capital gains. Web deducting office supplies and office expenses, the new simpler irs rule for expensing rather than depreciating, and. Web. Can I Write Off Work Supplies.

From www.tffn.net

Understanding Tax WriteOffs A Comprehensive Guide The Enlightened Can I Write Off Work Supplies Typically, you can’t write off work clothing or personal expenses for appearance. Web if your company incurs any expenses whatsoever in order to carry out your usual work, they should be written off (or written down) from your total taxable. Web the short answer: Get help from a tax professional for depreciating equipment or reporting capital gains. Web this article. Can I Write Off Work Supplies.